In a foreign country such as Mexico, setting up manufacturing has its own set of complexities. Understanding Mexican regulations and laws, and the customs and laws corresponding to those of the United States, can help you save time and avoid frustration. Here is some advice for helping to cut the red tape when starting a manufacturing operation in Mexico.

Table of Contents

Starting Out: Do the Research and Legwork First

If you begin your manufacturing company in Mexico without a clear plan, you are likely to fail. Take the time to do your research and gather this information before you get in touch with anyone about starting your manufacturing company. Knowing the regulations and information you will need beforehand will greatly reduce the time navigating the rules and regulations between the U.S. & Mexico.

Knowing local regulations is essential to doing business in Mexico successfully.

Here are some ideas as to where you should start:

- What kind of goods do you wish to make? Depending on the type of goods you want to make and how you want to import them back into the United States, there will be different issues involved. Determining the materials you will need to make is done through the bill of materials. The bill of materials (BOM) is an extensive list of raw materials, components, and instructions for manufacturing your product. After you have established what materials you need to manufacture your product, you will need to locate raw materials. When manufacturing in Mexico, the number of materials you import may affect the amount of import/export duties that you will have to pay. Finding local sources for raw materials can help reduce the amount of duties that you have to pay later on your finished product.

- Where do you want your manufacturing to be located? It’s critical to consider where your manufacturing operations are located. If you want to ship frequently into the United States, you’ll want to be near the US/Mexico border or near a port of entry. You may be required to observe local legislation in Mexico, depending on the city or state.

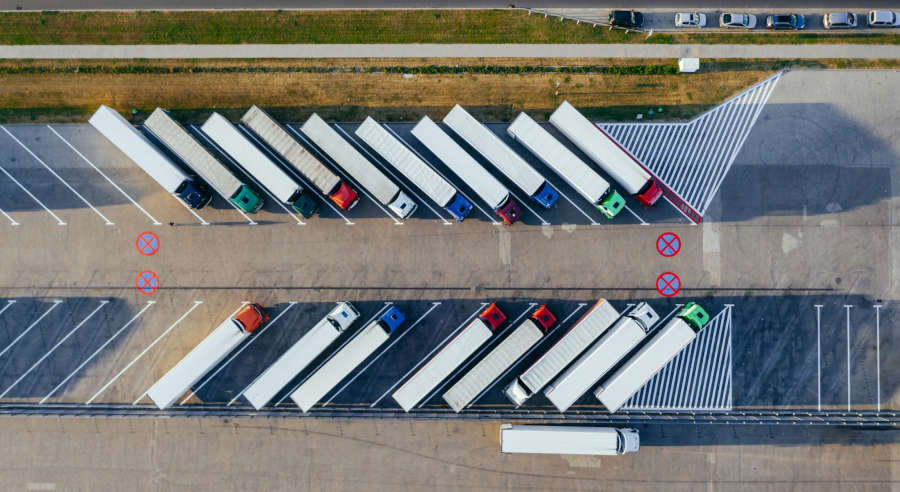

One of Mexico’s greatest advantages for manufacturers is its proximity to the US market. Manufacturing in Asia involves longer lead times and higher shipping costs.

- When do you plan to start? If you want your manufacturing company in Mexico to get up and running right away, you’ll need to have all the specifics worked out and ready to go before you arrive. This could take months, or possibly a year, depending on the size of your business (if you try and do everything on your own.)

- Do you wish to start on your own or do you want to use a shelter model? The shelter manufacturing model allows foreign manufacturers to establish manufacturing facilities in Mexico—known locally as maquiladoras—without having to go through all the paperwork that is typically required for starting a Mexican company. It will be cheaper to do everything yourself to get your manufacturing up and running in Mexico, but it will also be considerably more difficult and time consuming. Going it alone could result in a slew of mistakes as you navigate the Mexican government’s requirements. Finding a manufacturing shelter partner in Mexico will be a smart choice if you want things to move rapidly.

Translate English to Spanish

Get top quality translations from English to Spanish or Spanish to English.

Get a Translation Quote

Familiarize Yourself with the USMCA and the IMMEX

If you are planning on doing manufacturing in Mexico, you need to familiarize yourself with two acronyms: USMCA & IMMEX.

According to Investopedia, USMCA is “…a trade deal between the three nations which was signed on November 30, 2018. The USMCA replaced the North American Free Trade Agreement (NAFTA), which had been in effect since January of 1994. Under the terms of NAFTA, tariffs on many goods passing between North America’s three major economic powers were gradually phased out.”

What Is the Significance of USMCA?

The USMCA is significant for many reasons, but the most important one is that you will experience financial savings. A reduction in tariffs between the nations, the encouragement of investments in industrial buildings in North America, and the opening of international markets are a few examples.

What Is the Significance of IMMEX?

Businesses with manufacturing operations in Mexico should also know about the labor cost savings provided by IMMEX (“Manufacturing, Maquila, and Export Services Industries Program,” also known as “Maquiladora” in Spanish). IMMEX was created in the 1960s as a manufacturing solution to take advantage of favorable tariff agreements between the United States and Mexico and to stimulate foreign investment in that country.

IMMEX allows manufacturers to use imported raw materials on a duty-free basis, greatly increasing their savings.

Manufacturers that use the IMMEX program can save money on operations that firms that use manufacturing options in other nations, such as China, do not. The IMMEX program enables manufacturers to cut costs by exporting supplies and equipment to Mexico on a temporary duty-free basis, having them manufactured or assembled, and then re-sent to the United States for sale or distribution. Furthermore, the IMMEX program provides American manufacturers access to a big, skilled, and economical labor pool for their operations.

Most importantly, IMMEX provides exemptions from the Value-Added Tax, or “VAT”. All temporary imported equipment, tools, and materials used in production while in a manufacturing plant in Mexico are excluded from the entire 16 percent VAT tax under the IMMEX program.

If your firm is establishing operations in Mexico, it may take many months to receive the advantage of the deferred VAT tax through IMMEX. This is owing to the difficulty of achieving the Mexican government’s criteria for IMMEX recognition or VAT certification.

Like the Article?

Click here to share on Twitter>>

Tweet

Click here to follow IVANNOVATION on Twitter and be first to learn about our new content>> Follow @ivannovation

What Companies Often Overlook When Starting Manufacturing in Mexico

When getting started with manufacturing in Mexico, it is easy to overlook important details. The following items are not essential to getting your manufacturing operations up and running, but if they are not addressed before operations begin, they will impede your progress.

Certificate of Origin:

The most important thing that people overlook is that anything going into Mexico must be accompanied by the appropriate documentation, such as a certificate of origin.

What is it? According to the International Chamber of Commerce, “A Certificate of Origin (CO) is an important international trade document that certifies that goods in a particular export shipment are wholly obtained, produced, manufactured or processed in a particular country. They declare the ‘nationality’ of the product and also serve as a declaration by the exporter to satisfy customs or trade requirements.”

This is where it must be determined whether the material is to be exported temporarily or permanently entered into the country via a value statement. If a product’s materials are permanently imported into the country, the duties are different. In the case of temporary imports, the goods will be converted into finished products before leaving the country.

Be aware of the certificate of origin. While raw materials may be brought in duty-free under IMMEX, goods that will stay permanently or will be sold in Mexico will be subject to tariffs.

The certificate of origin will also play an important role in determining where the product was labeled as being manufactured. As a result of the new USMCA, the country of origin might change. If a product is being manufactured or converted in Mexico, it may not be labelled as “made in Mexico.” This will depend on the origin of its key components.

HTS Code:

One of the most important things to do is to get an HTS code for your product. HTS stands for Harmonized Tariff Schedule. You can find the HTS code for your product on the U.S. International Trade Commission website.

HTS codes are important for a number of reasons. For instance, if your finished product is not USMCA compliant, the HTS code can tell you whether it will be subject to duties upon return to the U.S. based on the raw material source. This enables you to make changes so everything is USMCA compliant, thus avoiding having to pay duties.

Understanding Tariff Shifts:

Having a general understanding of tariff shifts is essential since they can be very complex. It is important to understand how a tariff shift can play a significant role in the amount of duties that a product must pay.

According to the International Trade Administration, under the USMCA, one of the ways you might qualify your product under Rules of Origin is by tariff shift.

Tariff shifting allows you to qualify your product under the Rules of Origin for USMCA and pay less on import duties. When non-originating components undergo a significant transformation, such as being combined together to make a new product, they are given a preferential tariff under the USMCA.

Avoiding Supply Chain Problems with CTPAT:

Customs Trade Partnership Against Terrorism (CTPAT), an initiative of CBP Office of Field Operations, ensures that trade partners receive preferential treatment in foreign countries only if they are certified.

According to Security magazine, “All companies must go through an extensive supply chain security audit and process to eventually get this certification by the government and ultimately speed up their way through security checkpoints, including ports of entries. For companies manufacturing and shipping from Mexico and Canada, it is of particular importance since it can be the difference between longer wait times at the border to cross merchandise. Having a certification allows for expedited treatment through segmented traffic lanes and decreased secondary inspections at those points of entry.”

If your company has not taken CTPAT into account, it may experience supply chain delays due to rigorous security checks.

As global supply chains experience more problems than ever before, avoiding further delays in getting your goods into the U.S. should be a priority.

Go to top

Manufacturing in Mexico—Get Consultant Help

If you find all this daunting, you might consider hiring a consulting firm specializing in setting up manufacturing in Mexico. With the complexity of government regulations in Mexico,a shelter manufacturing partner can help guide you through the intricacies of getting your business up and running.

It may be more expensive to work with a shelter manufacturing partner, but there is no doubt they will be able to assist you in cutting through the red tape and getting your production operating more quickly. For example, certifications for CTPAT and IMMEX can take up to 6-12 months. However, when you choose a shelter manufacturer who is already CTPAT and IMMEX compliant, you won’t have to worry about getting these certifications for your operations since the partner will be able to represent you.

Mexico has millions of skilled and knowledgeable workers ready to do manufacturing for your company.

Shelter manufacturing partners are familiar with Mexico and its society. Understanding the culture and laws of Mexico is one of the biggest challenges facing companies that manufacture in that country. Often, the unfamiliarity of doing business in Mexico results in unplanned surprises, delays, and costs. Their presence can act as a buffer between you and Mexican society for any cultural differences you may not understand.

The process for manufacturing in Mexico can be complicated, but with a strategic plan, lots of research, and the assistance of a manufacturing partner, the process can be greatly simplified. By taking the time to familiarize yourself with Mexican regulations and laws as well as U.S. laws and customs, you can avoid frustration and save time & money.

About the Author: Michael Dillon is the Vice President of Marketing & Business Development for NovaLink, a nearshore manufacturing company.

Get free translation tips straight to your inbox!

- Get tips on how to translate your website, marketing materials!

- Get actionable advice to help you succeed with international business.

- Be the first to access free language and management tools.